Fierce war to bag AI talent shifts to India with salaries being doubled

Aditya Chopra isn’t looking for a new job, but recruiters keep calling him anyway. The 36-year-old data-science specialist works in artificial intelligence, perhaps the most coveted experience on the planet after OpenAI demonstrated the breakthroughs of ChatGPT. Chopra, who works outside of New Delhi, sees friends in the field get pay hikes of 35% to 50% each time they switch jobs. “There’s a real shortage of data and AI talent,” he said.

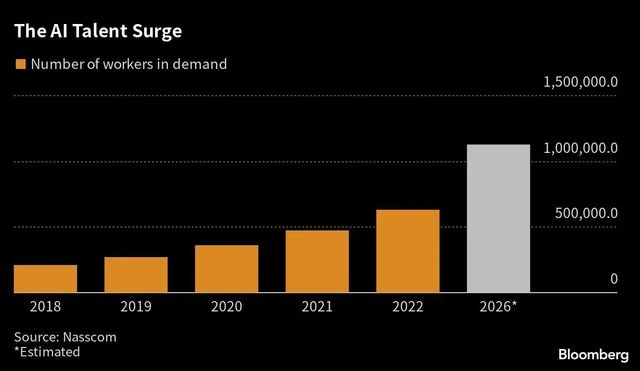

India, perhaps more than any other country, illustrates how the rush for talent is outstripping supply. The country of 1.4 billion people has long been the back office for the tech industry, a source of reinforcements for any emergency. But now even the world’s most populous nation is running out of the data scientists, machine-learning specialists and skilled engineers that companies are looking for.

Recruitment stories verge on the absurd. In one search Shah’s firm just handled, the new employer more than doubled a candidate’s pay. Freedom Dumlao, chief technology officer of Flexcar, interviewed one engineer who said a rival suitor had offered him a BMW motorcycle as a sign-on bonus. “That’s a line I’m not comfortable approaching,” Dumlao said.

Powerhouses like Google, Microsoft Corp. and Amazon.com Inc. set up their own operations in India, hiring locals by the thousands. Google, now part of Alphabet Inc. started with five employees in the country in 2004 and now employs nearly 10,000.

)

It’s likely to get worse. India added 66 tech innovation centers, so-called global capability centers or captives, last year taking the total to nearly 1,600. These GCCs that used to handle tasks like IT support and customer support have morphed into in-house centers for business-critical technology — like AI. In the first three months of 2023, asset manager AllianceBernstein Holding LP, car rental company Avis Budget Group Inc., entertainment conglomerate Warner Bros. Discovery Inc. and aircraft engine maker Pratt & Whitney set up R&D hubs in Bangalore, joining the likes of Goldman Sachs Group Inc. and Walmart Inc.

Last year, Dallas-headquartered ANSR set up 18 such captives in India; Ahuja expects that number to hit 25 this year. “Many enterprises which have India captives are accelerating their AI road map to derive a competitive edge.”

“The talent crunch is going to worsen in the next year or two,” said Biswajeet Mahapatra, principal analyst at Forrester Research Inc.

)

Dumlao of Flexcar, a Boston-based car subscription startup, says that’s not enough. He has been hunkering down in Bangalore for the past three months trying to assemble a team of data engineers and computer-vision specialists for the startup’s data science hub in the city. Flexcar’s team of 60 engineers helps build AI applications to automatically detect damage when vehicles are returned. The startup has embraced ChatGPT and is piloting a chatbot to help technicians diagnose and fix vehicles by querying trained bots.

Dumlao’s competitors come in all shapes and sizes. Chilean retailer Falabella SA is the first Latin American company to open a captive in India for data analytics, AI and machine learning. “We have to compete with the best of the best,” said Ashish Grover, its Santiago-based chief information officer. The efforts are paying off: a personalized customer platform now accounts for over half the incremental sales from digital targeting. An AI-fueled recommendation engine has driven three times more conversions on its mobile app.

This being India, many workers are trying to retrain themselves to land a coveted job in AI. Data engineer Deepak Kapoor, who works for a startup called Thinkbumblebee Analytics, is studying up on computer vision and large language models to move into deep learning, where job opportunities are plentiful. He thinks he could easily double his salary in a city like Bangalore.

“We haven’t even touched the tip of the AI iceberg,” he says.

For more latest Economy News Click Here