Building entry barriers in fintech; and other tech & startup stories this week

The free run that Indian fintech founders had is a thing of the past. Not only has the regulator stepped in to check the speed of innovation, but banks are also looking to work only with regulated fintechs.

“It is better to work with regulated players. It will be slower, but at least there will not be any sudden shocks,” a senior banker at a private sector lender told me recently.

By shocks, he meant things like digital lending guidelines, which disrupted fintech lenders, or rules around the flow of credit through prepaid channels, which disrupted business for Slice and Uni.

Excited at the prospect of quick customer acquisition and snazzy digital properties, there was a time when banks partnered with as many fintechs as possible. But now they are turning cautious.

“We need to focus on building our own stack and I think we are all entering the zone where we need to work with a select few fintechs across sectors we want to (target),” said another banker. Areas like credit cards and quick personal loans through consumer applications are good opportunities.

“But we need to take a hard look at opportunities around neo banking, account opening etc,” he added.

Shared responsibilities

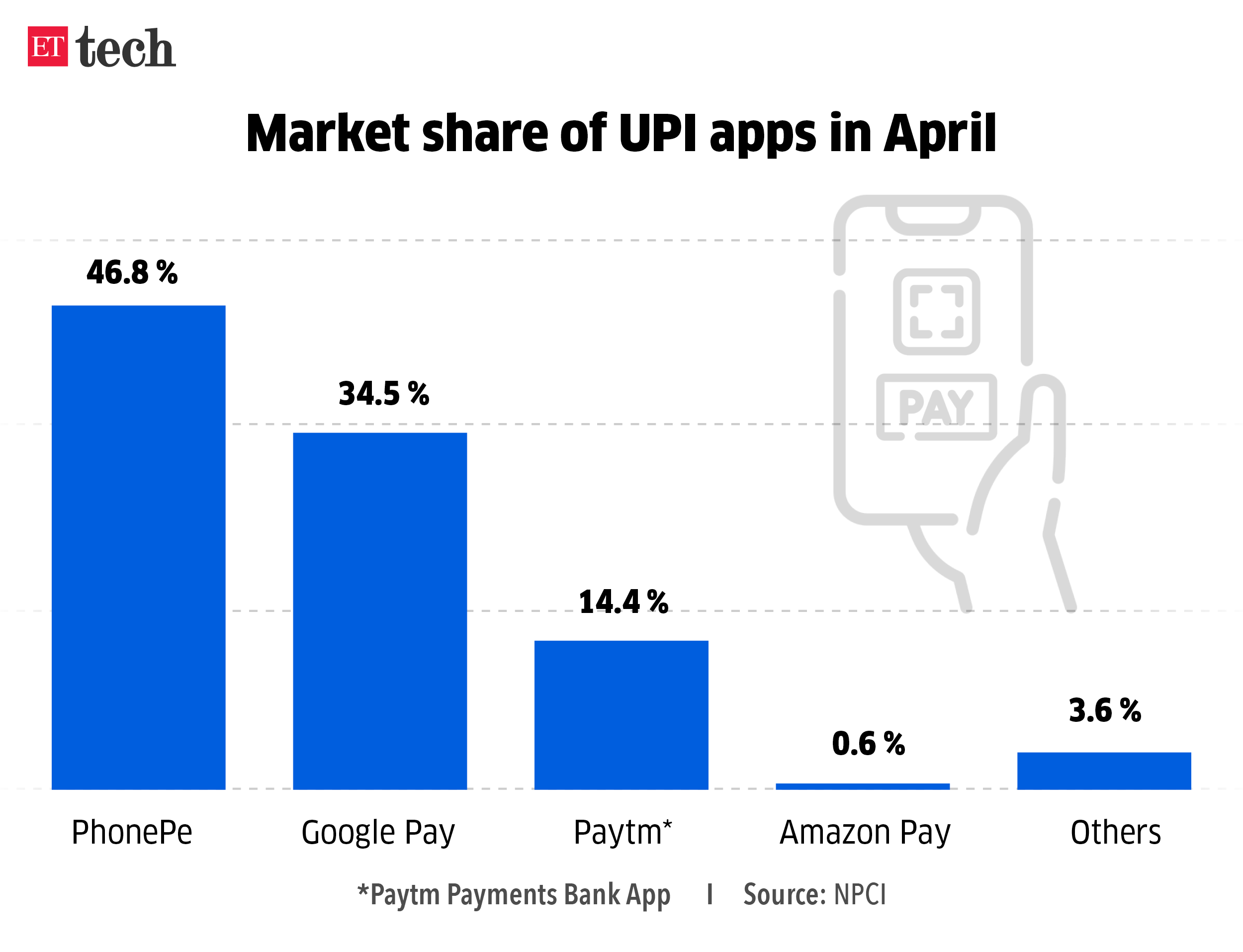

The first era of fintech was all about competing with banks. It played out in a profound way in the wallet space, where banks were competing with wallets for retail payments. But with UPI, it became more collaborative. The same was the case with the RBI’s co-lending guidelines — it became more about working with large lending partners rather than disrupting lending. But now fintechs are getting edged out.

“The new features on UPI are getting launched with banks first. That way, they can be tested in a regulated environment and eventually be opened for fintechs,” said one of the bankers quoted above.

In the lending space also, it is the larger lenders that have a distinct advantage over fintechs. And for those fintechs that do not have an NBFC licence, the game is restricted to just being a sourcing agent, which means limited revenue-generation abilities.

Cases like ZestMoney are making banks even more cautious. If the lending and loan management stack is not able to detect ballooning bad assets, then what is the technology that fintechs are bringing, they ask.

Entry barriers

So, to ensure stability, banks are pushing their large fintech partners to secure an operational licence.

And that is exactly what is happening. In the credit space, Cred, BharatPe and Jupiter are all NBFCs now. In the payment space, players are under payment aggregator regulations.

This will bring more stability to the sector, but what this also creates is entry barriers for future innovators. Any disruptor will have to consider a hundred things before they can start working in the fintech space.

For instance, there were experiments being carried out on student credit, prepaid cards for the entire family, sound-based payments, and innovative models in B2B credit. With so many early-stage founders finding it difficult to scale up in this protective environment, will entrepreneurs get inspired to start up? And even if they do, if banks do not support them, how can they experiment with their products?

“There will be sandbox initiatives at the regulator’s end and at the banks’ end, which should keep encouraging innovations, but in the long run, the sector will stabilise,” said one of the bankers quoted earlier.

Just as chaos gives rise to ideas, stability makes things boring. Will India’s enterprising (read jugaadu) founders still manage to push the envelope or will they get preoccupied with audits, filings and compliance? We will keep tabs on that.

Now moving on to other top stories this week.

ETtech Exclusives

Sales grow quickest via quick commerce for packaged goods: Senior executives at multiple consumer goods companies including Britannia and Nestle have said that sales through Swiggy’s Instamart, Zomato’s Blinkit, Zepto, and BigBasket’s BBnow are growing faster than traditional ecommerce platforms.

But will quick commerce catch up with the likes of Flipkart and Amazon? Perhaps not. Because now is a time when new users are hard to come by for quick commerce companies as they struggle to expand beyond the top cities.

Paytm opposes IAMAI’s submission to panel on digital competition law: A critic of Big Tech companies like Google, Paytm has formally opposed the Internet and Mobile Association of India’s final submissions to the Committee on Digital Competition Law (CDCL), multiple sources told ET.

ET had reported on May 13 that IAMAI had submitted its views to the CDCL opposing the prescription of ex-ante regulations for digital companies, saying that ex-ante measures “may limit growth not only of the market in question but the digital economy altogether”.

AWS CEO on $12.7 billion India investment, ChatGPT challenge, and how cloud tech will enable $5 trillion economy goal: India is an “incredibly energised, high growth market,” according to Adam Selipsky, the newly appointed chief executive officer of Amazon Web Services (AWS), the $80 billion cloud computing arm of online retail giant Amazon. In the coming decade, the Seattle-based company will invest about $12.7 billion to expand its business in India, he told ET while pointing to the country’s “tremendous” economic development in the previous ten years.

Earnings Report

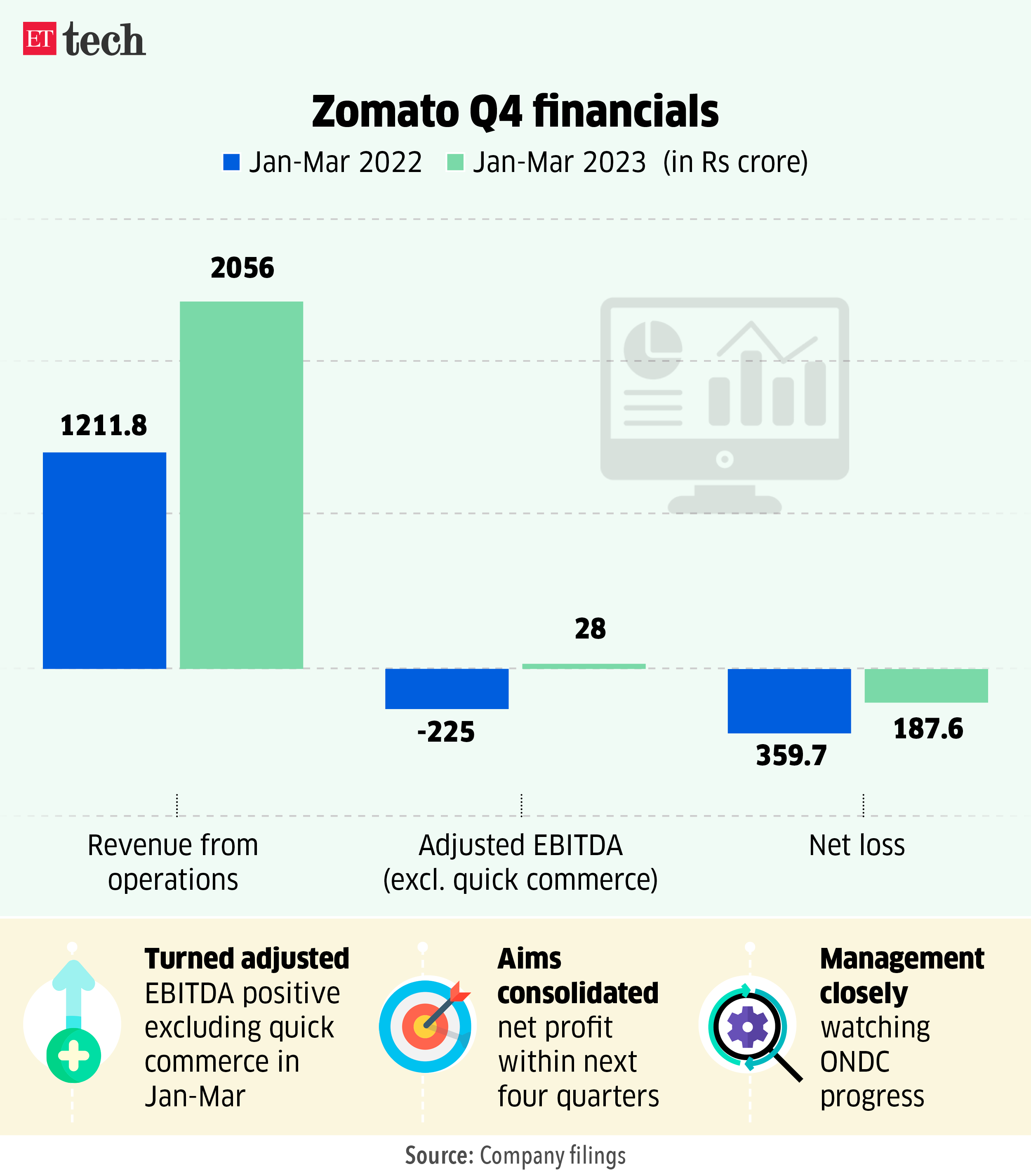

■ Zomato Q4 Results: Consolidated loss narrows to Rs 188 crore, revenue surges 70% YoY

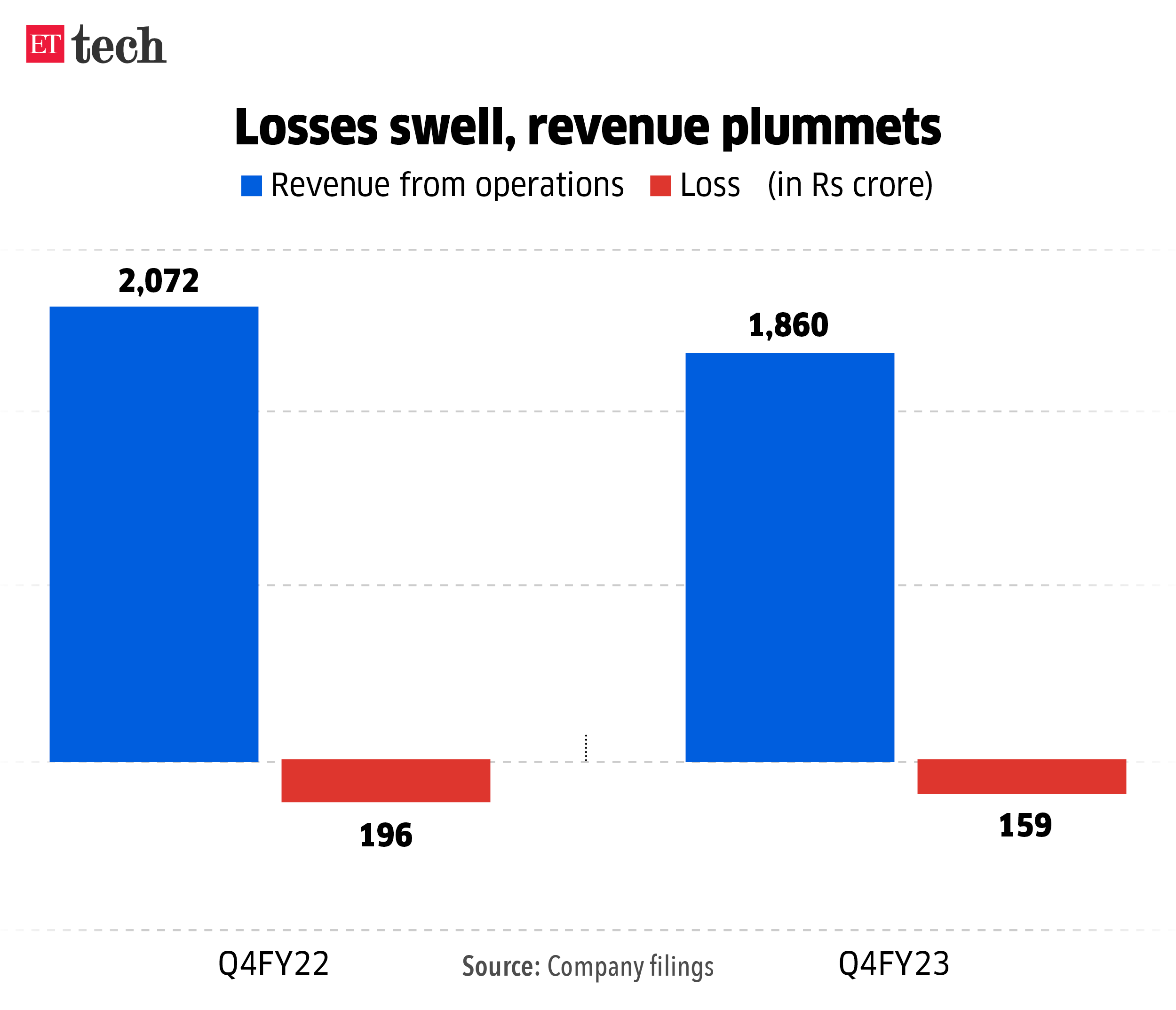

■ Delhivery Q4 Results: Loss widens to Rs 159 crore; revenue falls 10%

■ Flipkart posts double-digit growth in sales, PhonePe crosses $1 trillion in transactions processed

ETtech Deep Dives

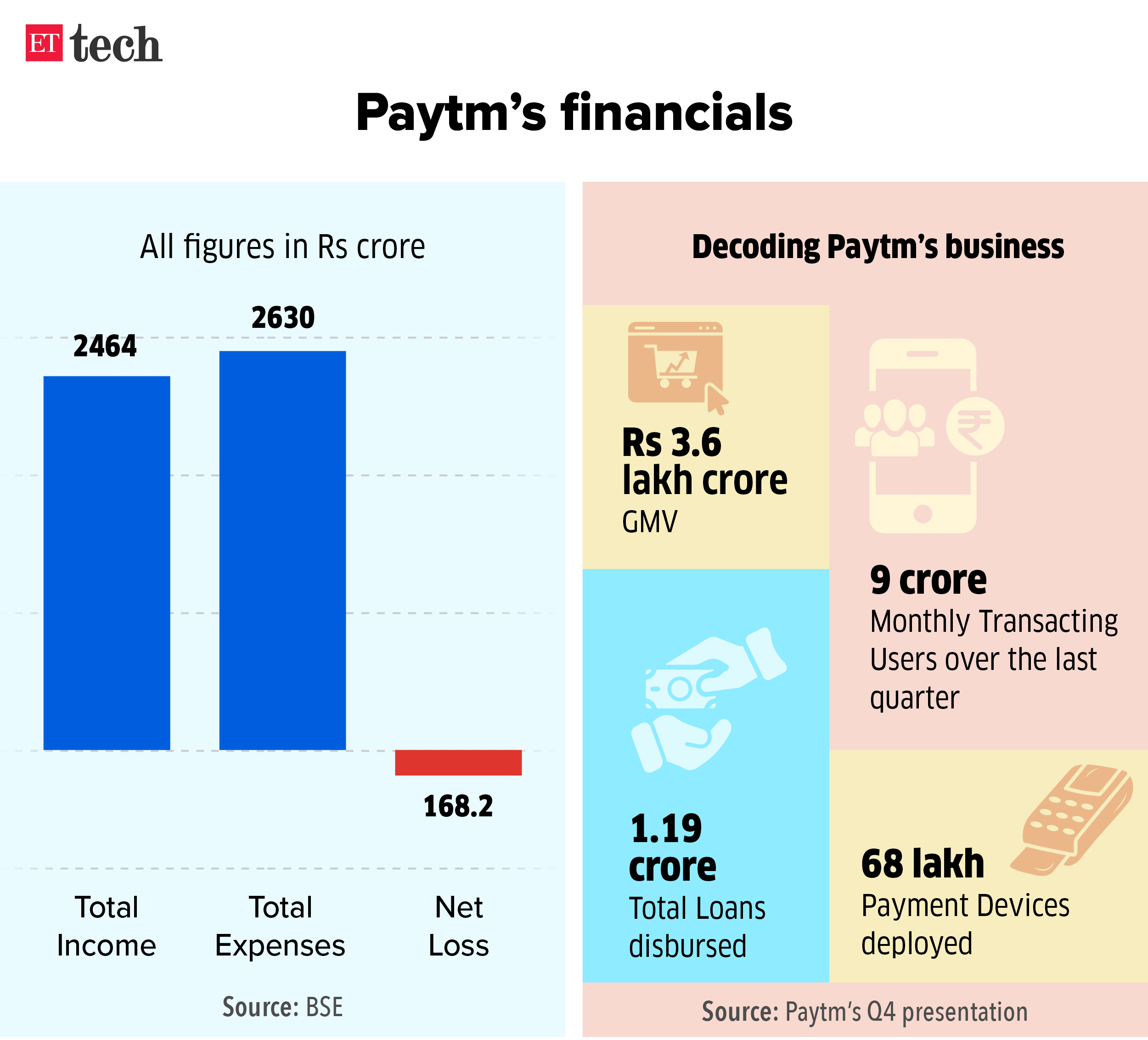

■ Decoding Paytm’s aggressive lending and collections playbook

■ Inside the changing VC deal terms as easy startup funding era ends

Fintech Corner

■ ZestMoney founders leaving troubled fintech firm post PhonePe deal collapse

■ Lending taps starting to dry up for crisis-hit ZestMoney

■ RBI planning strict rules for firms offering payments via PoS machines

■ Payments council pings FM Nirmala Sitharaman to bring back RuPay MDR

■ Zomato starts own UPI offering, Flipkart to follow suit

Tech Policy

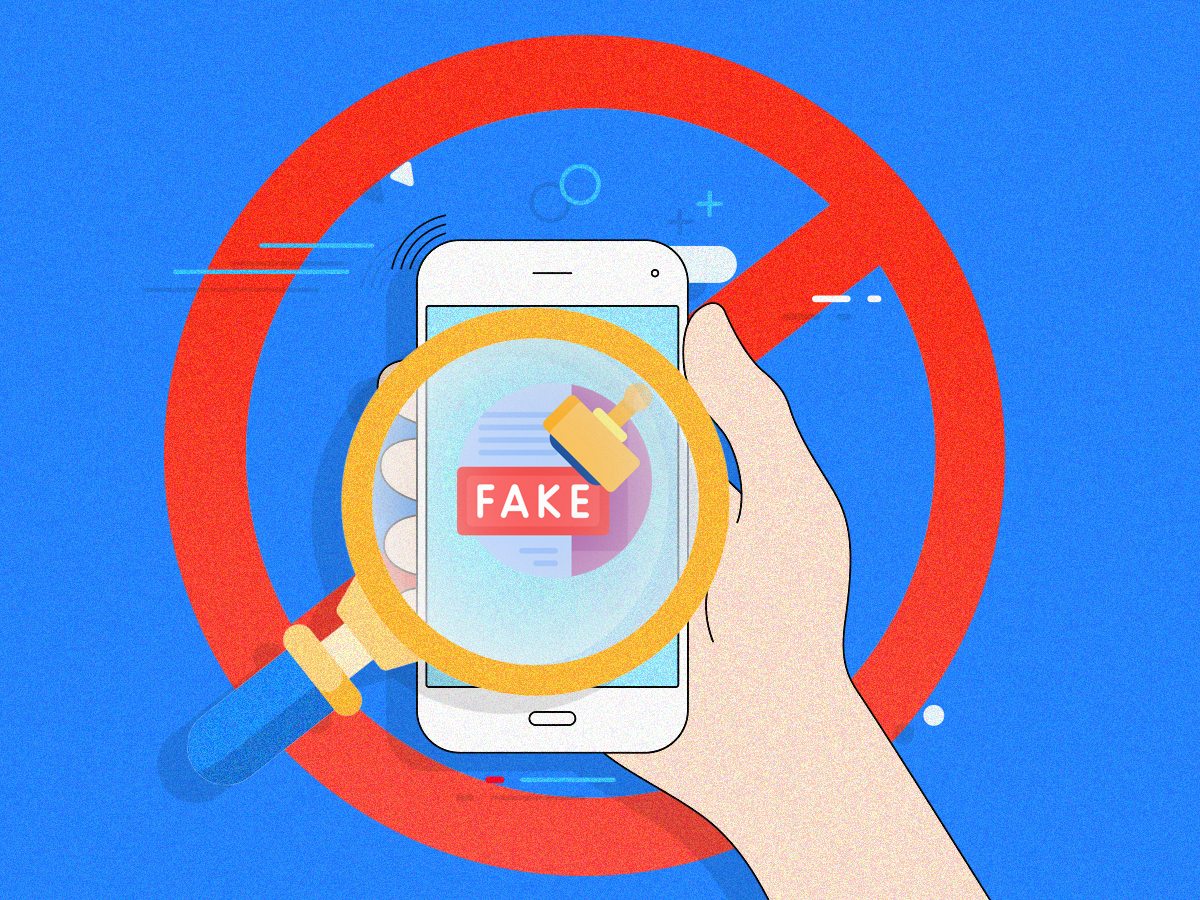

■ MeitY likely to lead proposed body to fact-check government news

■ Vedanta-Foxconn chip factory set to get green light

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

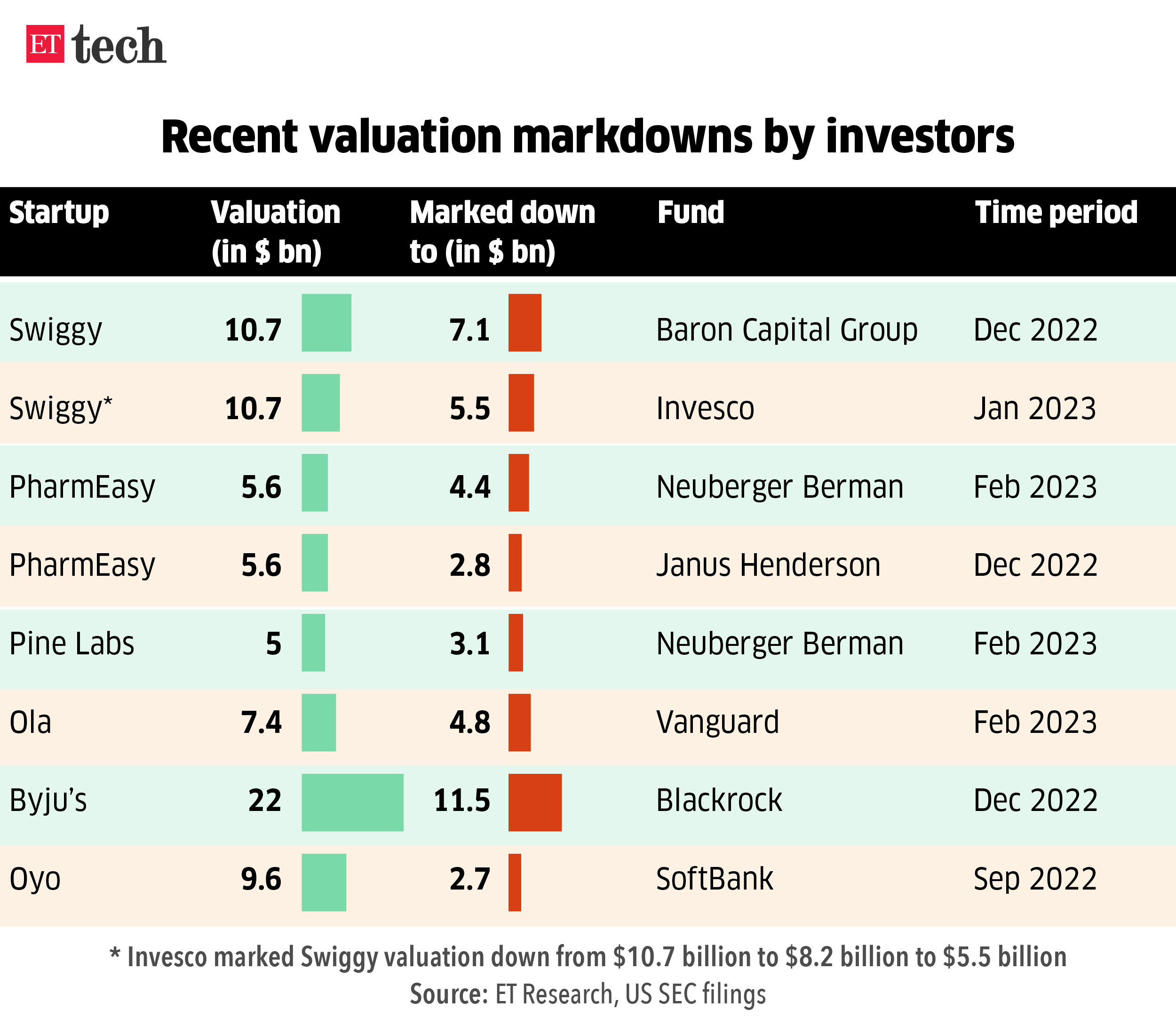

Markdowns Continue

■ US investor Janus Henderson cut PharmEasy valuation by half to $2.8 billion

■ US investor Baron Capital marks down Swiggy’s valuation by 34% to $7.1 billion in latest filing

Tweet of the day

ETtech Deals Digest

■ Puma India head Abhishek Ganguly’s new startup raises $52 million funding

■ Nodwin Gaming raises $28 million in funding from Nazara, Sony, Krafton

■ Data analytics company Course5 Intelligence raises $28 million

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines. For all the latest Technology News Click Here